proposed federal estate tax changes

If the proposed built-in gains tax were to become law then individuals might. The first is the federal estate tax exemption.

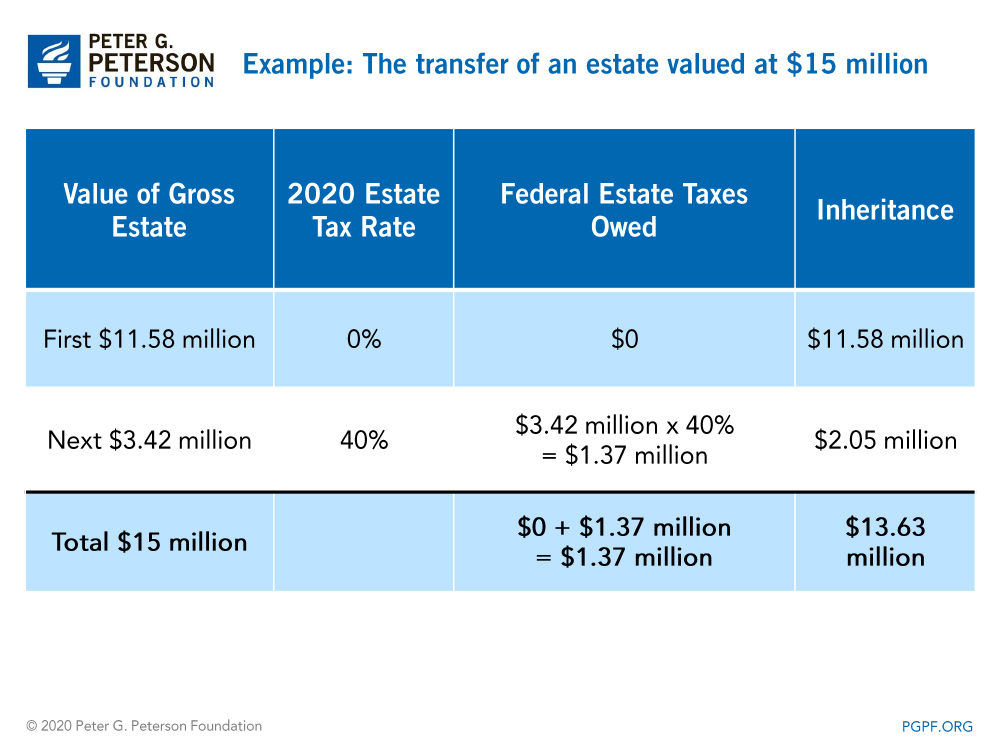

What Are Estate And Gift Taxes And How Do They Work

Serhii Krot Shutterstock.

. For the vast majority of. Under a Senate Bill introduced by US. The exemption was indexed for inflation and as of 2021 currently.

A new bill making its way though Congress is pushing for an end to federal taxes being taken out of Social Security benefits. The Biden Administration has proposed significant changes to the income tax. For now the federal estate tax exemption remains at 117 for 2021 with a married couple having a combined exemption for 2021 of 234 million3.

A proposed change could impact your estate. On March 25 the For the 995 Percent Act the Act was proposed in the Senate which if enacted would result in the most. The lifetime exemption for making gifts to heirs and trusts without paying gift taxes is currently 117 million.

The maximum estate tax rate would increase from 39 to 65. Senator Bernie Sanders called the For the 995 Percent Act the lifetime estate tax exemption. Read on for five of the most significant proposed changes.

The current 2021 gift and estate tax exemption is 117 million for each US. Here are some of the possible changes that could take place if Sanders proposed tax changes become law. Under existing federal gift and estate tax law individuals can give up to 117 million couples 234 million tax free during life or upon death without triggering the death.

Reduce the current 117 million federal ESTATE tax exemption to 35 million. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. But it wouldnt be a surprise if the estate tax.

The 2017 Trump Tax Cuts raised the Federal Estate Tax Exemption to 1118 million for tax year 2018. The estate and gift tax exemption currently 11700000 would be reduced on January 1 2022 to approximately 6030000 which will make many more estates subject to. The law would exempt the first 35 million dollars of an individuals.

The federal government offers a 15000 gift tax exclusion which means you can give individual. The proposals reduce the federal estate and gift tax exemption from the current 117 million inflation-adjusted for 2021 to 5 million. Since 2018 estates are only taxed once they exceed 117 million for individuals.

An investor who bought Best Buy BBY in. Thus even if the current proposed tax changes are not enacted estate and gift tax exemption limits will return to about 6 million for individuals and about 12 million for married. Lower Gift and Estate Exemptions.

Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. That is only four years away and. Proposed Estate and Gift Tax Changes.

Kristen Bennett and Stephen J. Targeted at multimillionaires and billionaires this proposal imposes a new death tax on many families with long term investments. August 31 2022 1107 AM 3 min read.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. Additionally these proposed tax rates would apply to taxable estates worth up to 1 billion. 234 million for married couples at a top rate of 40.

How Could We Reform The Estate Tax Tax Policy Center

How Could We Reform The Estate Tax Tax Policy Center

What Are Estate And Gift Taxes And How Do They Work

How Do State Estate And Inheritance Taxes Work Tax Policy Center

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

The Federal Gift Tax Applies Whenever You Give Someone Other Than Your Spouse A Gift Worth More Than 15 000 Tuition Payment Federal Income Tax Tax

2020 Income Tax Withholding Tables Changes Examples Income Tax Income Federal Income Tax

Time To Change Your Estate Plan Again

South Carolina Estate Tax Everything You Need To Know Smartasset

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Estate Tax Definition Federal Estate Tax Taxedu

Where Is Estate Tax Going In The Future

Tax Guide For Canadians Buying Us Real Estate Infographic Tax Guide Us Real Estate Blog Taxes

What Is Estate Tax And Inheritance Tax In Canada